9/10/2021 Democrats Eye Taxing Stock Buybacks and Partnerships to Pay for Agenda, by Jonathan Weisman and Peter Eavis, The New York Times

Buybacks have come under withering criticism since former Trump’s huge corporate tax cut was enacted in 2017.

Proponents of that legislation promised that companies would use the tax law’s windfall to boost worker wages and grow their businesses. Instead, it touched off an explosion of stock buybacks that critics say has made top executives and industry insiders even more wealthy. In 2019, the largest American companies spent a record $728 billion on stock buybacks, a 55 percent increase from 2018, according to Senate Finance Committee data.

Companies in the S&P 500 spent $6.2 trillion on new plant and equipment in the 10 years through 2020, according the Times’s analysis, a similar amount to what they spent on buybacks over the same period.

"Triumph of the Libertarian Will" - The Full Flower of Laissez Faire

Who will Libertarians cast as Leni Riefenstahl?

This ideologically pure piece of "I can do whatever I want on my property" Libertarian mode

housebuilding appeared on Whitmore Lake's East Shore Drive several years ago. Cable and Telephone

lines were deflected laterally by the impinging roof structure. After roofing, the cable and telco lines

rubbed raw against the abrasive coated roof shingles for years. Eventually the lines were elevated.

Lying is a Choice

Lying is a Choice

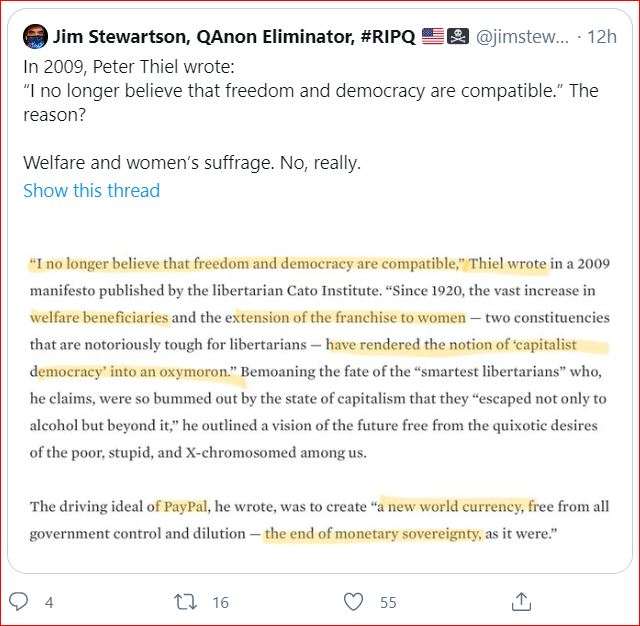

Libertarian, Misogynist, Billionaire Creep. (and wannabe Vampire)

"Deregulate" "There's too much regulation, too many regulations." "Freedom"

2/26/2021 Impacts of PFAS could ripple for years in Livingston County, despite progress, by Jennifer Timar, Livingston Daily

In July, the Michigan Department of Health and Human Services announced the "do not eat fish" advisory will remain in place as more data is collected.

In Livingston County, the advisory includes:

- The Huron River

- Kent Lake

- Ore Lake

- Strawberry Lake

- Zukey Lake

- Gallagher Lake

- Loon Lake

- Whitewood Lake

- Base Line Lake

- Portage Lake

- connected bodies of water in Oakland, Washtenaw and Wayne counties.

That covers pretty much all the area lakes except Horseshoe and Whitmore Lakes. Which means lakeside property is even more priceless.

Such a great time to sell North Village lakeside parkland for a song! Expecially to build ticky-tacky crackerboxes squeezed into trailer park sized lots.

Watery Victory for Michigan Libs whining about "burdensome regulation, unnecessary regulation, freedom-hating regulators"

Owners of dams flooding Midland ignored federal regulators for years

"Government can't do anything well." "Volunteers." "Pay for it with contributions."

1850 “The state shall not be party to, or interested in, any work of internal improvement, nor engage in carrying on any such work...” Michigan 1850 Constitution

1844 Private Turnpike Companies:

Beginning in 1844, private turnpike companies attempted to fill this void with a network of toll roads, portions of which were constructed of wooden planks. Although these companies had to be chartered by the state and were required to construct and operate their roads according to certain standards, these toll roads were entirely the responsibility of private enterprise. This was significant because it marked the only time that public roads in Michigan were not a direct government responsibility. One of the first plank road companies, the Detroit and Port Huron, was chartered in 1844. Several more of these private toll road companies were established during the next few years, and in 1848 the state legislature passed a General Plank Road Act to regulate their operations.

Plank roads were required to be from two to four rods wide, 16 feet of this to be a “good, smooth, and permanent road”. Eight feet of width was to be of three-inch plank. For two-horse wagons and carriages, as well as “for every score of neat cattle”, a toll of two cents per mile was permitted. For one-horse vehicles, the maximum rate was one cent per mile. Altogether, more than 202 companies were chartered, although most never began operations. The Detroit and Pontiac Plank Road was opened late in 1849. The Detroit and Howell—50 miles long, with 10 toll gates along Grand River Road was completed in 1851. It was soon discovered, however, that the planks decayed rapidly and that the roads could not be kept up from the tolls received. “Mark Twain, who traveled to Grand Rapids by stage to give a lecture, was asked how he had liked the trip. ‘The road could not have been bad,’ he replied, ‘if some unconscionable scoundrel had not now and then dropped a plank across it.’” Many companies abandoned operations after a few years and few were able to show a profit. However, this situation lasted only about 40 years as the toll roads proved economically impractical. The support by the legislature of private toll companies did not meet the needs of a well-planned road system.

Each able-bodied male living within a local designated road district was directed to work off his road tax at the rate of not more than thirty days per year. The road supervisor, who was elected by residents of the road district, had authority to determine the time and place for each citizen to work. In the event that the citizen could not work, his road tax could be commuted at the rate of 62.5¢ per day. Every able-bodied male was expected to work a certain number of days a year on road construction or maintenance. The road overseer notified all such township residents of the time and place of work; those that failed to report were penalized. A resident who provided a wagon, scraper, yoke of oxen, team of horses, or other equipment would be assigned a reduced number of work days. The statute labor system provided little cash for the purchase of road equipment or the hiring of full-time road personnel. Indeed, there was the prevailing view that no experience or training was necessary to build or maintain roads. Anyone who could operate a scraper or yoke of oxen could build roads, according to common belief.

The results of such amateur efforts were detrimental to an efficient system of roads; in fact, such efforts often left roads in worse condition than they were before such “repair work” had been initiated. One shrewd contemporary of the time observed:

The experienced traveler who finds himself at the beginning of a newly mended road will betake himself to the nearest house and learn how far the improvement extends; if for the distance of 10 miles, he will then inquire by what circuit, not exceeding 15 miles in length, he can escape from the danger of repairs. After a time nature mends the damage done by the process of reconstruction, and the journeyer may find once again a way tolerable…”

Despite the inefficiency of Michigan’s highway system, it was strongly defended by farmers of the state. They not only favored use of amateur personnel as adequate for the task, but they stoutly opposed any attempt to abolish the statute labor system in favor of taxation to finance roads. The depressed economic plight of Michigan farmers in the late 19th century helps explain this fear of increased taxation.

In 1907, the legislature repealed the act which had permitted citizens to work out their road taxes.

- excerpts from The History of Roads in Michigan, by Dorothy G. Pohl, Managing Director for the Ionia County Road Commission, and Norman E. Brown, retired MDOT Act 51 Administrator. It was presented to the Association of Southern Michigan Road Commissions on December 2, 1997