Who are Northfield Township's Biggest Losers? We are, the Taxpayers.

This is a preliminary report on the Township's $450,000+ investment losses.

Two weeks after his debut as Township Manager Howard Fink opened a Board discussion of investment policy. Invited to the May 14, 2013 Board Meeting were Emily Jones, the Multi-Bank Securities Account Executive who had worked with Township for the past 2 1/2 years, our Township Auditors, Chris Arsenault and John Pfeffer, and the Township Controller, Rick Yaeger. [LiveVideo] of the discussion.

Discussion of investments continued in Agenda Item 6 [LiveVideo] at the June 25, 2013 Board Meeting.

At this meeting, Manager Fink brought in a PNC Bank Investment Advisor/Salesman. He spoke about Michigan Public Act 20 (PA20), which regulates what can and cannot be done with the operating funds of municipal entities. Regarding the Township's investments, he said the Township should "drastically reduce" its risk.

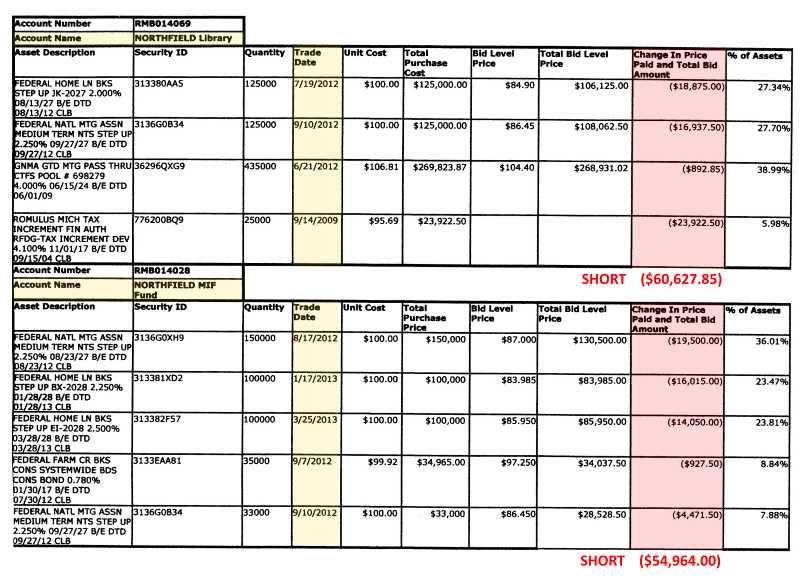

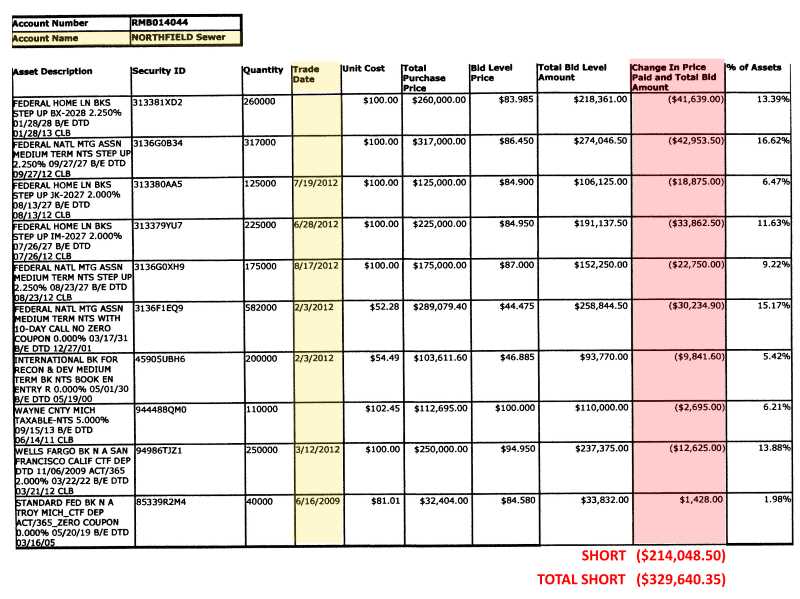

The discussion continued at the July 23, 2013 Board Workshop. At this meeting a Morgan/Stanley representative quantified the extent of the financial damage already done to the Library, Sewer, and General Funds. Were the collection of Bonds immediately liquidated, over $329,560 in losses would become real. The details are in the three tables below the next few paragraphs.

Unfortunately, of all the public Board Meetings held in the past twelve years, this was the only public Board Meeting where nothing was recorded. It was not broadcast on cable. It was not LiveStreamed. The Recording Secretary was de-invited, so there are no meeting minutes. Even the audio tape was erased immediately after the meeting. Manager Fink told us that this was a "workshop" concept, that Trustees would feel freer to discuss issues without being recorded, without being on the record. The "workshop" concept continues with the second meeting of every month. But the Board decided that subsequent Workshops would be Livestreamed, broadcast on Cable, and recorded by the Recording Secretary. 7/23/2015 was the only meeting where no record was left behind.

The 7/23 meeting packet is not on the Township website. By what must surely be a fantastic coincidence, the archives on Manager Fink's new Township begin with the records of the following meeting, 8/13/2013.

Fortunately Northfield Neighbors kept a copy of the three part 7/23 meeting packet. In part 1 of that packet, on pages 111 and 112, are the three tables below. They show the extent of the financial damage to the Library, General, and Sewer Funds.

In the tables below, the column titled "Trade date" is when the securities were purchased. Most of the money losers were bought in 2012. One was bought in 2009. Two were bought early in 2013. The purchase dates of three others are unnoted.

- Source: 2013-07-23 Board Meeting Packet, part 1, page 111

- Source: 2013-07-23 Board Meeting Packet, part 1, page 112

FYI: Federal National Mortgage Association is more familiar as "Fannie Mae."

The discussion of investments continued at the August 13, 2013 Board Meeting. [LiveVideo] of the board discussion.

At this meeting, the Board hired Morgan/Stanley to liquidate all their bond holdings. At that meeting, Wayne Dockett called it a $400,000.00 loss, which is more than the July 23 estimate and more than the $280,000.00 figure we've heard since then. We don't actually know the final damages and are crafting a FOIA to find out.

The damage was called $280,000.00 by Treasurer Braun at the July 28, 2015 Board meeting. The $280,000.00 doesn't even get a mention in the official Minutes. Braun's Agenda Item 7 Investment Policy discussion begins here - [LiveVideo]. This includes discussion of a future 24 month ceiling on investment maturities. Here are the LiveMeetingMinutes of the July 28th meeting.

The Bonds were paying interest of $50,000 - $60,000 / year. Adding in the lost interest in the three years since the fire sale, the Loss to the Township now totals about $450,000.

In contrast, the Northfield Township Libary Board did not panic. They exercised their independent authority. They refused to sell the bonds until the money was needed to defray the cost of the recent Library expansion. Patience paid off and they lost almost nothing. It turns out that the bonds had recovered most of their value. Not surprising since much of Europe is now paying negative interest rates on Bonds.

Below is the supporting documentation, excerpted from our collection of Board Minutes and Notes.

The Township website provides nothing dated before the 8/13/2013 meeting, the meeting which followed the big revelation that the Township had gambled away over $329,560.

2013-05-14-BOT-Minutes-p2 2013-05-14-BOT-Notes-p3

2013-07-23-BOT-Packet-Braun-Letter-p99

2013-07-23-BOT-Packet-Investment-Disaster-details-p111-112

2013-07-23-BOT-Packet-part-1.pdf 2013-07-23-BOT-Packet-part-2.pdf 2013-07-23-BOT-Packet-part-3.pdf

2013-08-13-BOT-packet-pt1-p65-68

State of Michigan Public Act 20 of 1943

Background: Board investment policy discussion,

2009-10-13-BOT-Minutes-p2 2009-10-13-BOT-Notes-p4-5

2010-01-12-BOT-Minutes-p2 2010-01-12-BOT-Notes-p3-4

On November 23, 2010 Mark Stanalajczo is appointed to the Board of Trustees. Ask George Brown about the details that don't appear in the Minutes.

2010-11-23 BOT Minutes 2010-11-23 BOT Notes

2010-12-14 BOT Minutes 2010-12-14 BOT Notes

Township Treasurer Wilson is not seen at a Board Meeting after March 22, 2011

2011-06-14-BOT-Minutes-p2-4 2011-06-14-BOT-Notes-p2-4

2012-02-14-BOT-Minutes-p2 2012-02-14-BOT-Notes-p3-4

2012-11-13-BOT-Minutes-p2-3 2012-11-13-BOT-Notes-p4

documents to come:

- Notes and Minutes documenting Treasurer's absence after March 22, 2011

Why are we rehashing this now? Because at the February 3, 2016 Planning Commission meeting, Commissioner Stanalajczo tried to lay the blame for the investments and the losses at the feet of the 2004-2008 Board of Trustees.

As shown by the Bond purchase dates, Stanalajczo was misinformed. He was right about one thing, though. An earlier version of this report stated that it was six months after the 2012-1016 Board took over that the Board allowed itself to be panicked and stampeded into selling the Bonds by the new Township Manager.

It was actually eight months.